Overview

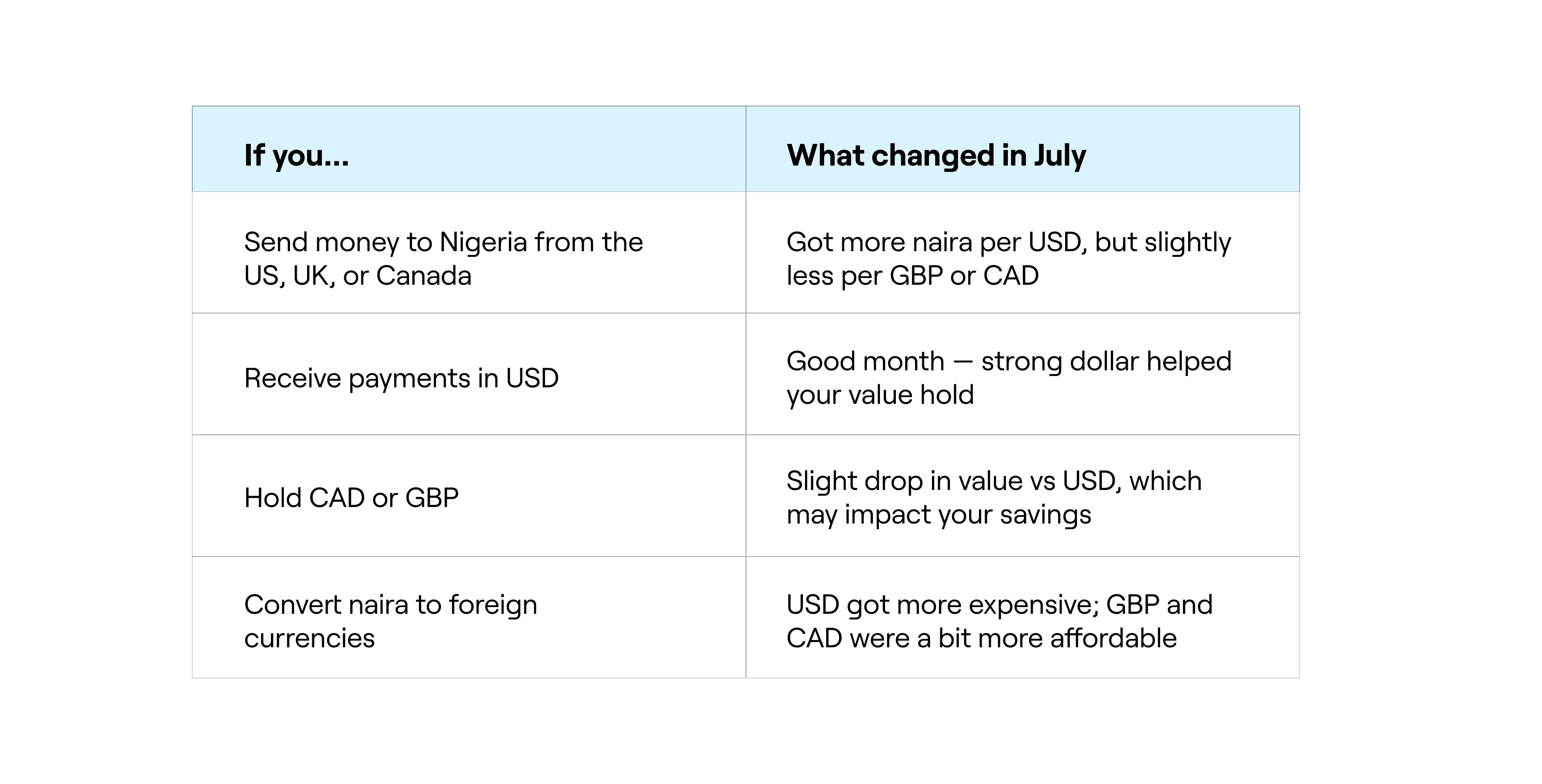

- USD gained ~5% in strength globally.

- Naira stayed stable officially, but dollar liquidity dipped.

- CAD and GBP both lost ground, widening conversion gaps for pay-ins and pay-outs.

- Businesses using USD as a value anchor fared better in July.

- A major tariff announcement from the U.S. helped spark risk-off sentiment globally.

🇺🇸 The US Dollar Got Stronger

The US dollar had a very strong month in July. The Dollar Index (which tracks how USD compares to other major currencies) rose nearly 2%, as the US economy showed signs of strength:

- US economic growth stayed solid

- Inflation cooled just a little, but not enough to push for immediate rate cuts

- Aggressive new tarrifs on Chinese, Indian and Brazilian imports, among others created a sense that the US was doubling down on protecting its economy, pushing safe-haven demand toward the U.S. dollar.

- With limited alternatives, the USD stood alone as a high-yield, low-risk asset—amplifying dollar inflows.

All of this made global investors trust the dollar more, driving up demand and value.

🇳🇬 What This Meant for the Naira

The naira stayed relatively stable in July, trading between ₦1520–₦1570 per USD in the parallel market for most of the month.

Still, dollar supply dipped slightly as demand went up, especially with global prices rising. So even though we didn’t see a big crash like earlier this year, it became a bit harder (and more expensive) for businesses and individuals to source large amounts of dollars.

If you were sending money to Nigeria or receiving USD payments through Juicyway, you might’ve noticed:

- More naira for every USD you converted

- But also higher USD rates when trying to buy dollars

🇨🇦 🇬🇧 What Happened to the Canadian Dollar and British Pound?

🇨🇦 Canadian Dollar (CAD)

- The CAD weakened by about 1.7% in July, trading around ₵1.38 per USD.

- Even though inflation rose to 1.9%, most people expect Canada might cut interest rates soon — and that tends to push a currency down.

- If you receive CAD or convert it to USD, you probably noticed a slight drop in what you got back.

🇬🇧 British Pound (GBP)

- The pound held up okay, but soft UK data — like flat growth and low spending — caused a slight slip.

- GBP traded between $1.28–$1.29 in July.

- If you’re sending money from the UK or converting GBP to naira, you may have noticed it cost a bit more than usual.

What you can do

Personal account users:

- Check rates before sending: Timing matters. Even a ₦20 difference can stack up over time.

- Use Juicyway tools like deposit from domiciliary, payment links, and dynamic account numbers to optimize how you move money.

Juicyway Business Account Users:

Price in USD Where Possible

- If you’re in Canada, the UK, or Nigeria, quoting in USD protects against currency dips in CAD/GBP/NGN.

- Your international clients understand this—it reduces renegotiation headaches.

Monitor BDC Behavior

- Juicyway users who depend on cash settlements or open market rates should note that tight liquidity = slower processing + higher spread.

- Watch for August BDC trends or any CBN announcements that may shake things up.

Communicate with your Clients

- If your business makes international payouts (to staff, suppliers, or creators), a stronger dollar can raise your costs.

- Be transparent: Update payment timelines or adjust fee structures where needed.

July’s FX shifts prove it: the USD still sets the pace.

Juicyway gives you the tools to stay in control: transparent rates, multi-currency access, and fast global transfers.

Know more. Do better. Move money smart with Juicyway.