Across four major economies, 2025 has brought significant policy changes that are reshaping how small businesses operate and scale. Each country’s approach is different, but a shared urgency to fuel entrepreneurship, improve cash flow, and enhance tax fairness has taken center stage.

🇨🇦 Canada

Canada’s Small Business Deduction continues to offer a reduced tax rate (around 9%) on the first CAD 500,000 of active business income for Canadian-controlled private corporations (CCPCs).

Additionally, the federal government has announced that the Canada Carbon Rebate for Small Businesses will become tax-exempt — a measure expected to be enshrined in law this fall.

Why it matters:

The tax-free treatment of the rebate is expected to return over CAD 2.5 billion to eligible businesses across the country. Small firms in emissions-heavy industries — like logistics and retail — are direct beneficiaries.

🇳🇬 Nigeria

President Bola Tinubu recently signed four major tax reform bills. Key changes include:

- Exemption from Companies Income Tax (CIT) for businesses with annual turnover below ₦50 million

- Removal of withholding tax filing requirements for such businesses

- A streamlined structure across revenue agencies to reduce duplication and compliance costs

Why it matters:

These reforms ease the tax burden on Nigeria’s 41 million MSMEs, many of which operate informally. Analysts expect an uptick in formal registration and reduced friction, especially in sectors like services, trade, and light manufacturing.

🇺🇸 United States

In mid-2025, Congress passed a sweeping tax package, often referred to by its working title — the “One Big Beautiful Bill.” Highlights include:

- Making the Section 199A 20% pass-through deduction permanent

- Increasing the Section 179 expensing limit to $2.5 million annually, allowing small businesses to deduct equipment costs upfront

Why it matters:

These tax changes provide long-term clarity and cost relief for LLCs, S-Corps, and sole proprietors — especially in industries like construction, professional services, and retail.

🇬🇧 United Kingdom

The U.K. government is preparing new late-payment transparency rules for large firms. By autumn 2025, companies with over 250 employees will be required to:

- Publicly disclose supplier payment times

- Obtain board-level approval for payment practices

- Ensure most invoices are paid within 45 days

Why it matters:

Late payments are a major source of cash flow stress. According to the Federation of Small Businesses (FSB), around 50,000 U.K. SMEs collapse each year due to unpaid invoices. These new rules aim to create real accountability in enterprise supply chains.

What Does This Mean for You?

Governments are doing their part to simplify rules and force fairness into the system. But you still need tools that work across borders.

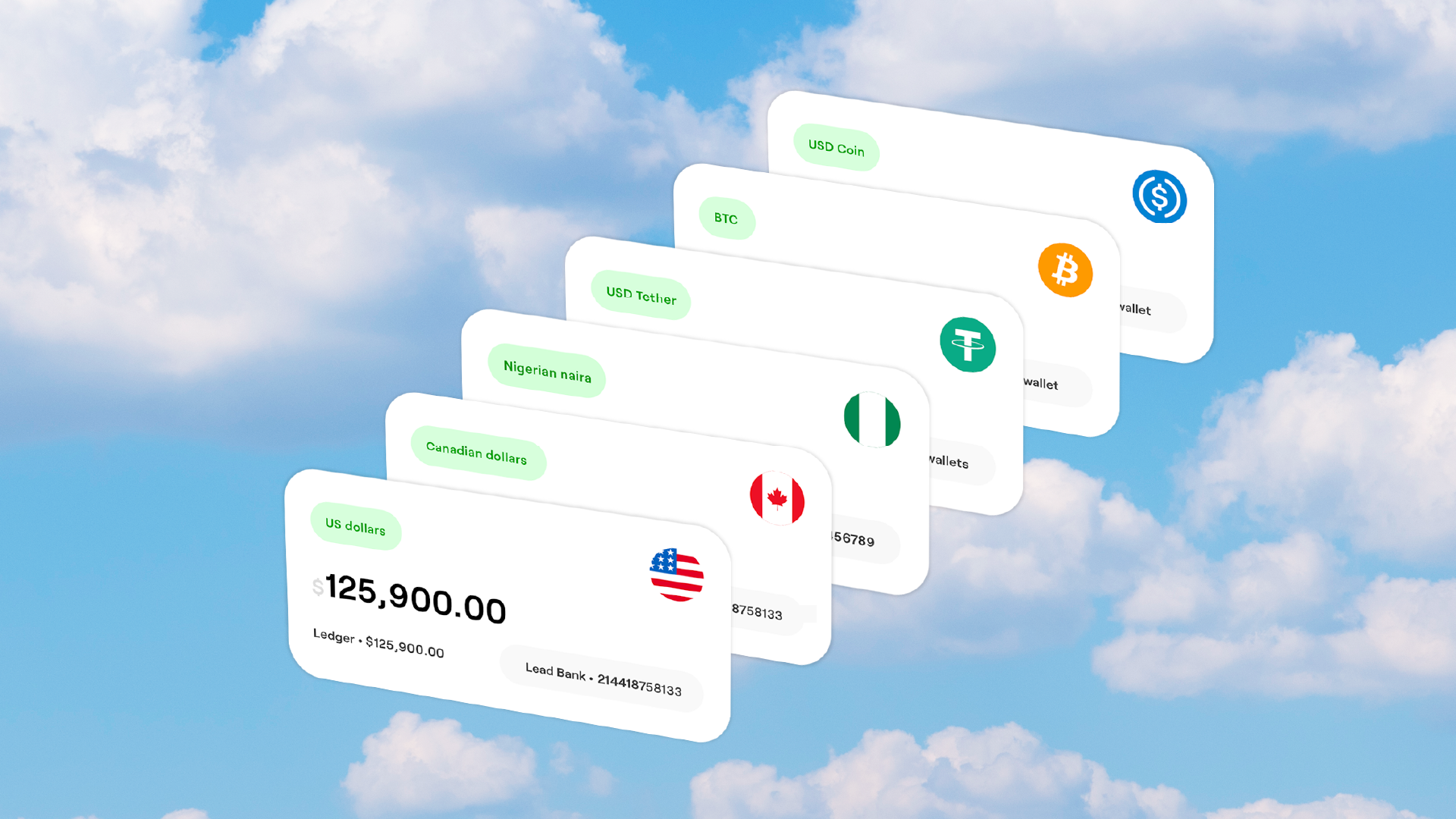

Juicyway gives you exactly that:

- ✅ Accept international payments

- ✅ Convert funds instantly

- ✅ Stay compliant without stress

- ✅ Access local bank details in multiple currencies

- ✅ Send money to vendors, staff, or suppliers — in Naira, USD, CAD GBP, crypto, or more

2025 is a good year to go global. And Juicyway is here to make it simple.