Testimonials from our Juicyway users often highlight one standout feature — how easy it is to send USD. Whether you're paying a business, sending to someone else, or funding your own account abroad, the process is fast, smooth, and 100% digital.

However we get it, some of our users are still unsure on how to take full advantage of this amazing feature.

In this article, we’ll walk you through;

- Why having a Juicyway USD account is a financial game-changer

- How to send USD to any other USD account (including yours)

- What you need to complete the transfer

- And how you can get the best out of your Juicyway USD account

Why Having a USD Account (Especially on Juicyway) Matters

Many don’t realise that inflation, FX restrictions, and cross-border limitations means that a naira account alone is no longer enough, especially for global transactions.

Some people who think USD accounts are only for those who earn in dollars, run export companies, or travel often, but the world we are in today has successfully debunked that; Now International NGOs & Charities, Students, and Shoppers all need USD access.

Hence why Juicyway is here to help.

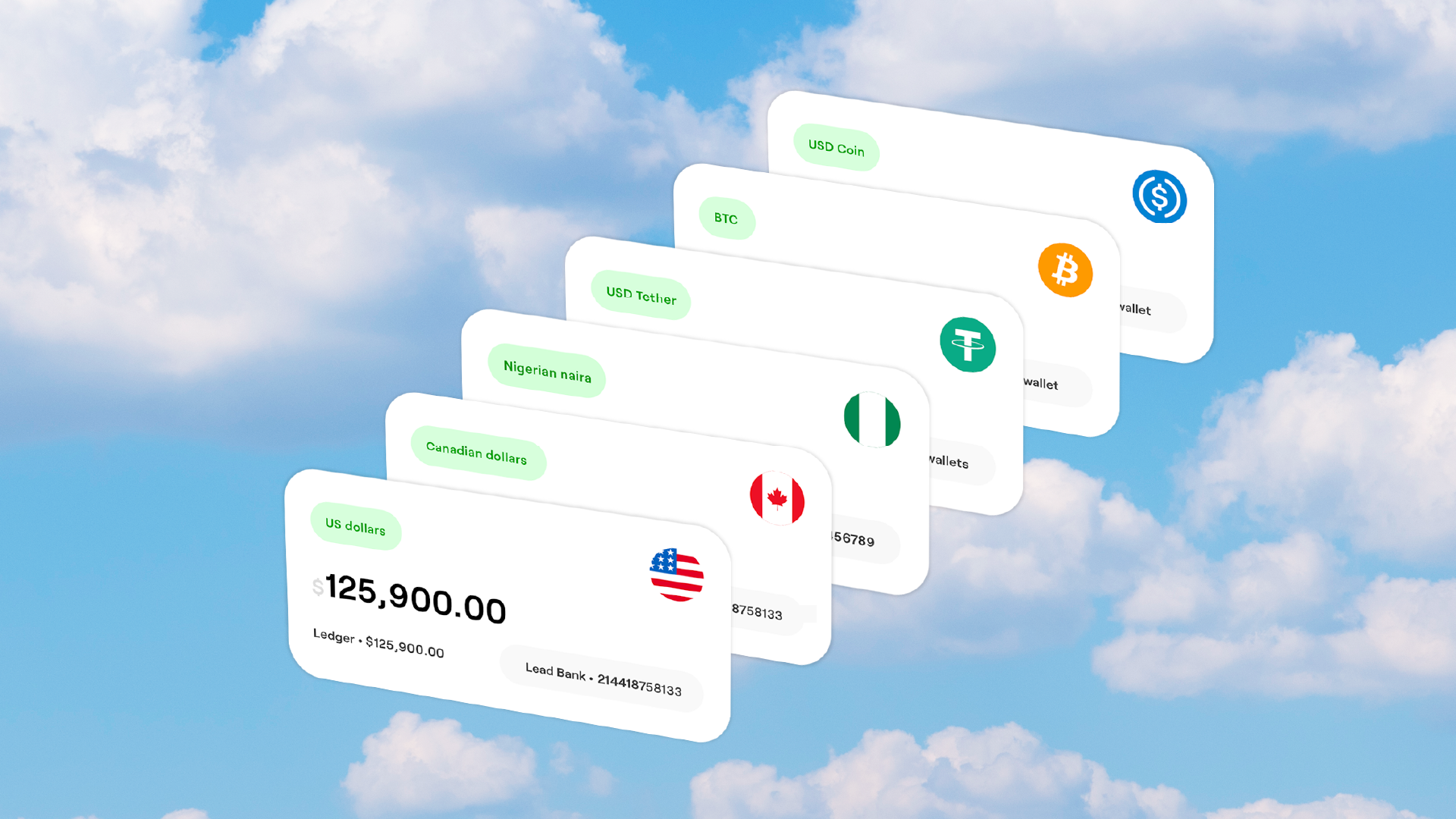

Having a USD account on Juicyway simply means;

- Free Deposits

- Amazing Rates

- One-time transaction fee

- Fast transactions via SWIFT, ACH or Fedwire direct to international and local banks

Our USD account gives you the power to send, receive, and save your dollars, which is especially useful if you earn in USD, shop internationally, or support your family abroad.

Sending Money in between USD accounts

To send USD to any account (your own, someone else’s, or a business), here’s what you’ll generally need.

For business accounts, you can send and receive ACH, Fedwire, and SWIFT payments worldwide, this gives you smooth control over your global transactions.

If you’re on a personal account, you can send and receive USD via ACH and Fedwire, but only receive SWIFT payments into your Juicyway USD wallet.

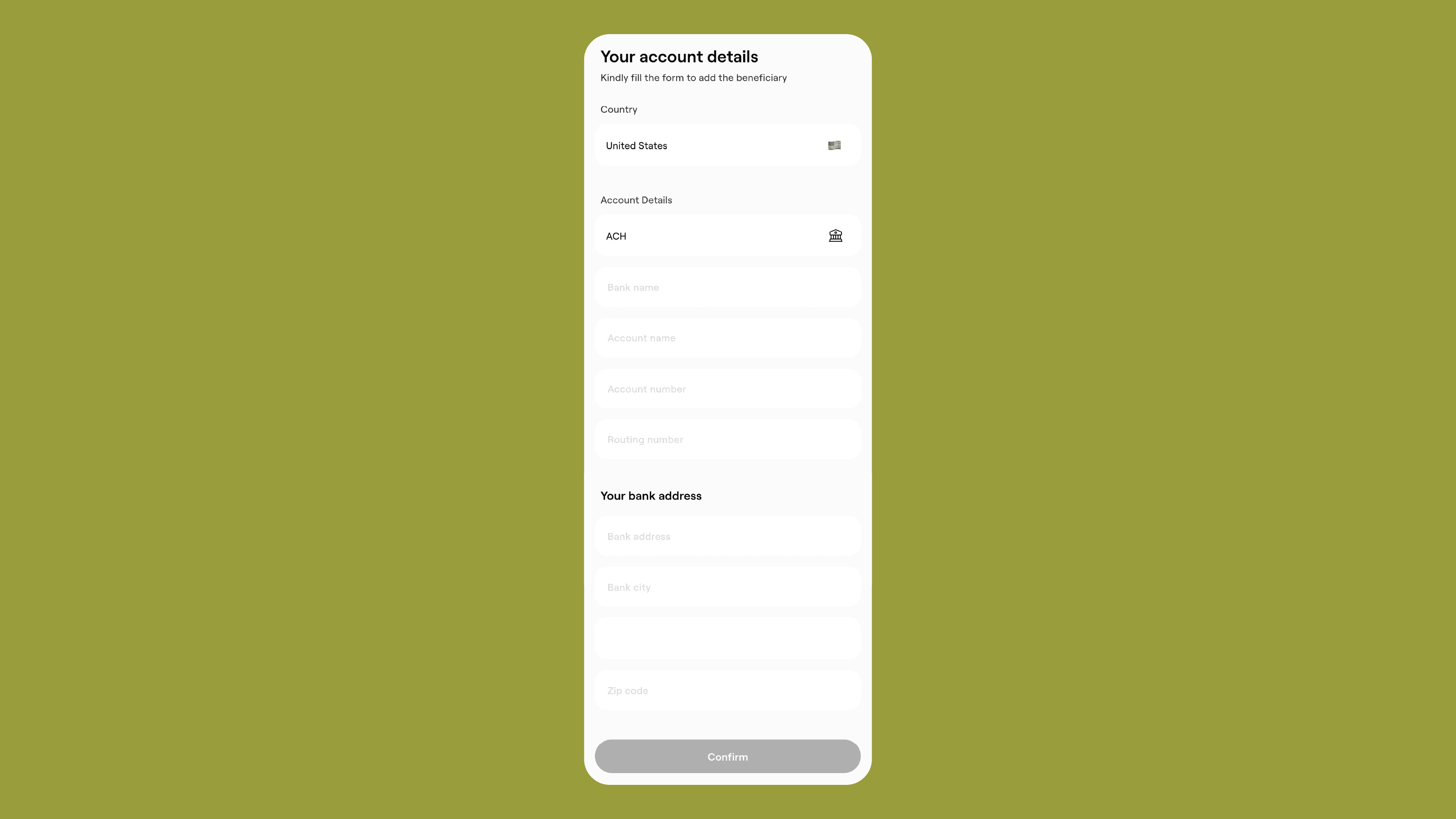

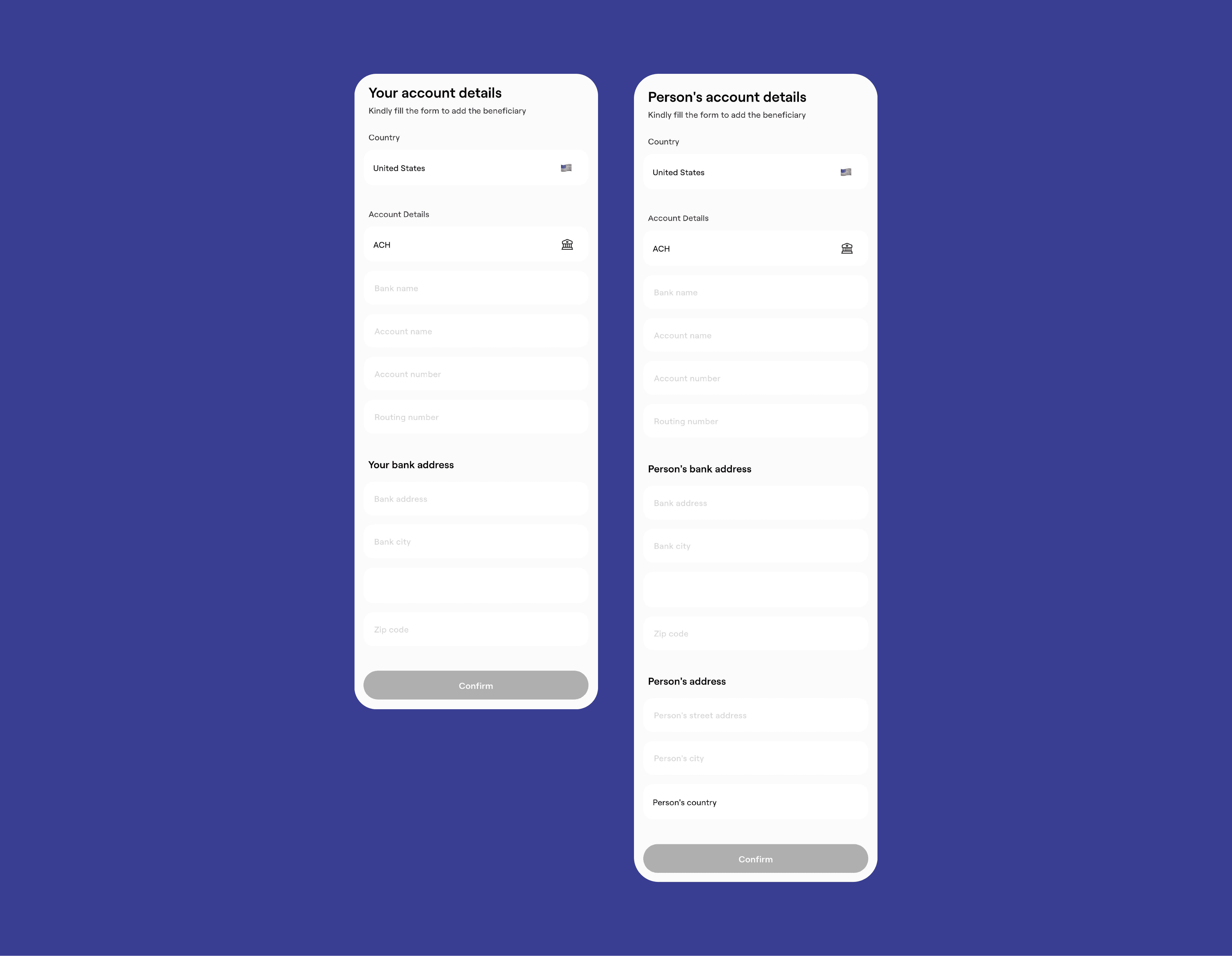

The only difference lies in who owns the destination account. To make things simple, we’ve grouped the required details into three clear sections: Transfer to Your Own USD Account

You’ll need to input the following details:

- Transfer type: ACH or Fedwire (for personal accounts, business accounts can select SWIFT)

- Your Bank Name, Account Name, Account Number, and Routing Number / SWIFT or BIC number

- Your Bank Address, City, and Zip Code

Transfer to Someone Else

- Transfer type: ACH or Fedwire (for personal accounts, business accounts can select SWIFT)

- Receiver Bank Name, Account Name, Account Number, and Routing Number

- Receiver Bank Address, City, and Zip Code

- Receiver Personal Address: Street, City, Country

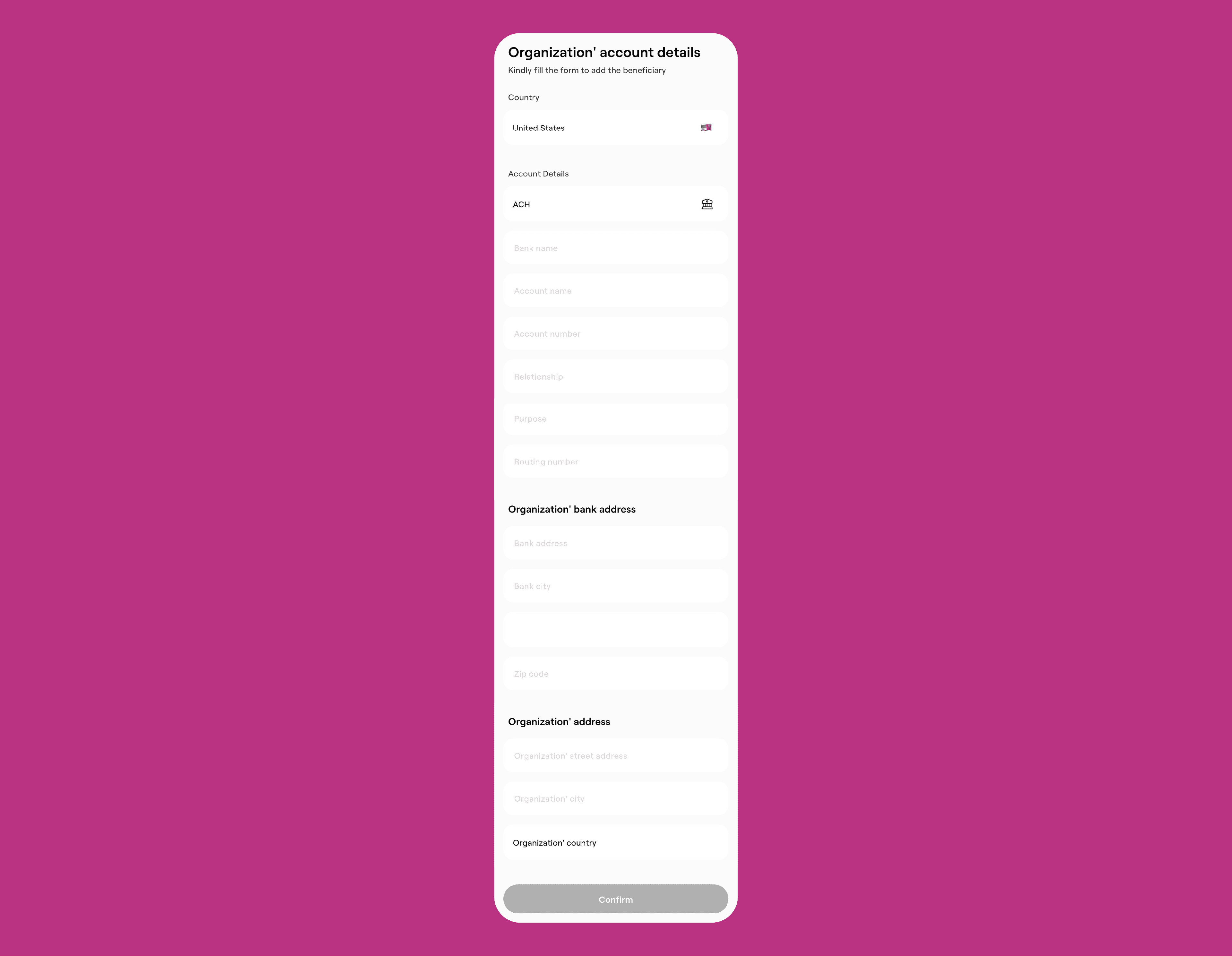

Transfer to a Business or Organization

- Transfer type: ACH or Fedwire (for personal accounts, business accounts can select SWIFT)

- Business Bank Details: Bank Name, Account Name, Account Number, Routing Number

- Relationship to Business and Purpose of Transfer

- Bank Address and Business Address: Street, City, Country, Zip Code

Things to Keep in Mind

- Choose ACH for standard transfers or Fedwire for urgent ones.

- If you have a Juicyway business account, you can both send and receive SWIFT payments.

- Double-check all details to avoid failed transactions.

- Transfers are usually completed within 1-2 working days.

Following these steps above, sending USD is now as easy as loading your Juicyway wallet.

Are you ready to try it out? Head to your Juicyway app and make your first USD transaction today. DISCLAIMER

The USD accounts referred to are domiciled in the United States. This publication is for informational purposes only and does not constitute legal, tax, or professional advice. Please consult a licensed financial advisor for guidance.