Nigeria's tax reform took effect on January 1, 2026. If you’re a freelancer earning in USD, GBP, EUR, or crypto, you've probably seen the headlines and wondered: "Does this affect me? What do I actually need to do?"

Let's break down what's changing, what applies to you, and how to stay compliant.

What's Actually Changing

1. Higher Tax-Free Threshold

The tax-free threshold increased from ₦300,000 to ₦800,000 per year. If your annual income is ₦800,000 or less, you pay zero tax. Above that, progressive tax rates of 15-25% apply depending on your income.

2. Foreign Income is Now Clearly Defined as Taxable

If you're a Nigerian tax resident (living in Nigeria for 183+ days in a year), your worldwide income is taxable. This includes:

- USD, GBP, and EUR earnings from international clients

- USDT or any stablecoin payments

- Crypto trading profits

- Salary paid in foreign currency

The law has always covered foreign income, but enforcement is stricter now.

3. Crypto is Taxed as Income

Crypto profits are taxed as part of your regular income, not as separate capital gains.

Before: Crypto profits were taxed at a flat 10% capital gains rate.

Now: Crypto profits are added to your total income and taxed at 15-25% (depending on your earnings).

Which means, if you made a $1,000 profit from crypto trading, convert it to Naira using the CBN rate when you sold.

That amount gets added to your total income and taxed using progressive rates.

Losses are not taxed, only profits.

4. You Must Have a TIN (Tax Identification Number)

All taxable persons must register for a Tax Identification Number (TIN). Even if you earn below ₦800k, you may need to file a Nil Return (declaring zero tax owed).

5. Self-Declaration is Solely Your Responsibility

Freelancers must self-declare their income and file tax returns annually. No employer is withholding tax for you; tracking, declaring, and paying is your responsibility.

6. Penalties for Non-Compliance

Failure to register for TIN:

- ₦50,000 for the first month + ₦25,000 for every month after

Failure to file returns:

- ₦100,000 for the first month + ₦50,000 for every month after

False declarations:

- Fine up to ₦1 million or 3 years imprisonment

What This Means for You

If You Earn in USD, GBP, or EUR

Convert your income to Naira using the official CBN exchange rate at the time you received payment. You cannot use black market rates; the CBN rate is what the law recognizes.

Example: You received $1,000 on March 15th.

If the CBN rate was ₦1,650/$1 on March 15th, your taxable income for that transaction is ₦1,650,000.

If You're Paid in Stablecoins

Stablecoin payments (USDT, USDC) are treated as foreign income. Convert the USDT value to Naira using the CBN USD rate at the time of receipt.

If You Trade Crypto

Crypto trading profits are taxed as income. You're taxed when you sell for profit, not when you're just holding. Losses aren't taxed.

How to Calculate Your Tax

Nigeria uses progressive tax bands, meaning different portions of your income are taxed at different rates. You don't pay one flat rate on everything.

Tax bands:

- ₦0 - ₦800,000: 0% (tax-free)

- ₦800,001 - ₦3M: 15%

- ₦3M - ₦12M: 18%

- ₦12M - ₦25M: 21%

- ₦25M - ₦50M: 23%

- Above ₦50M: 25%

How Does It Work

Think of it like climbing stairs; each portion of your income is taxed at its corresponding rate.

Example:

Let’s calculate the progressive income tax for someone earning $1,000/month, using:

- Monthly income: ₦1,433,590

- Annual income: ₦17,203,080

- Tax-free threshold: ₦800,000

- CBN Exchange rate: ₦1,433.59/$

- Taxable income: ₦16,403,080

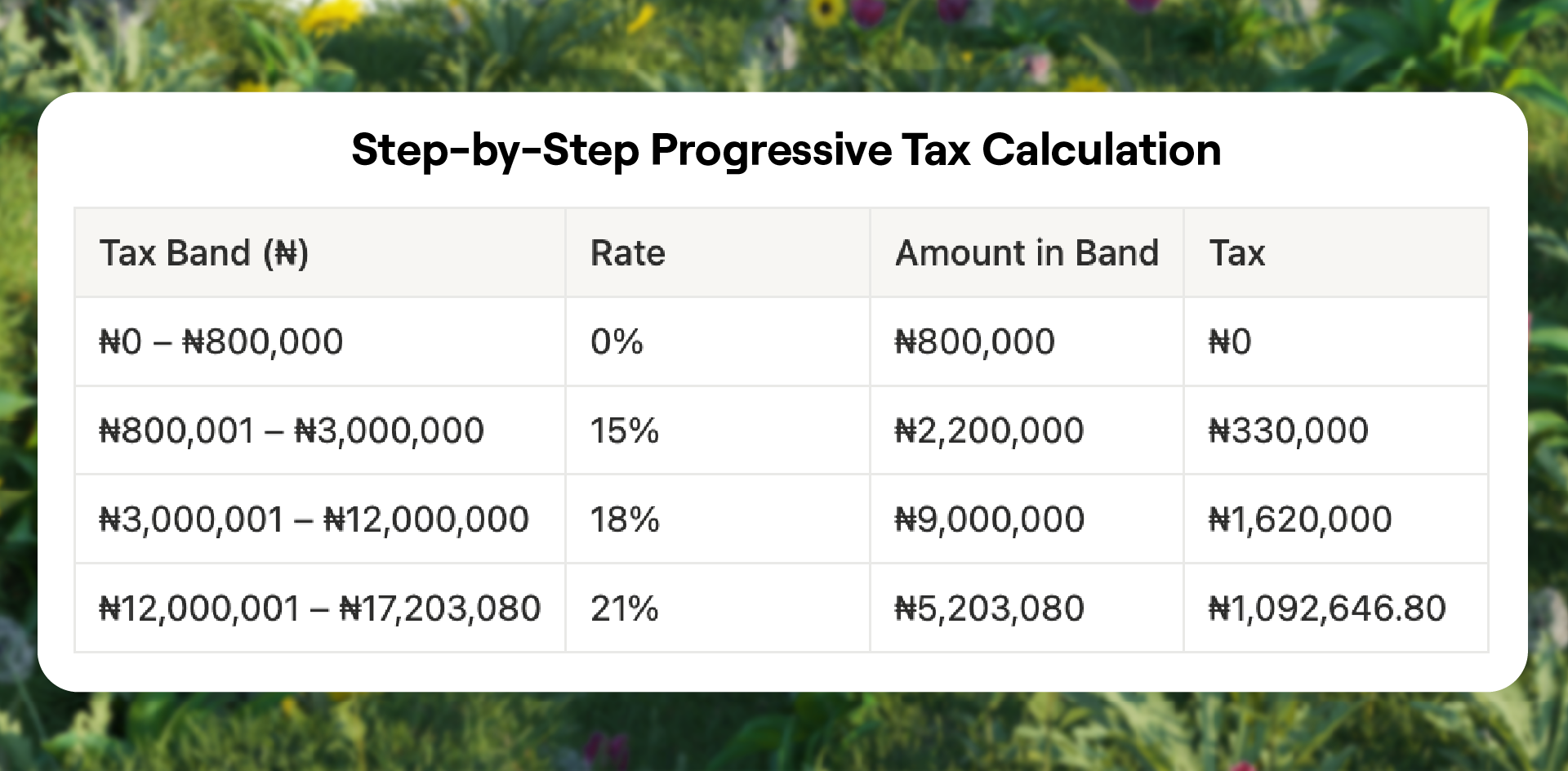

🧮 Step-by-Step Progressive Tax Calculation

Total Tax

- ₦330,000 (15% band)

- ₦1,620,000 (18% band)

- ₦1,092,646.80 (21% band) Total Tax Owed: ₦3,042,646.80

Effective Tax Rate

₦3,042,646.80 ÷ ₦17,203,080= 17.68%

💸 Monthly Summary

- Gross Monthly Income: ₦1,433,590

- Monthly Tax owed: ₦3,042,647 ÷ 12 ≈ ₦253,554

- Money left for you: ₦1,433,590 − ₦253,554 ≈ ₦1,180,036

Allowable Deductions

You can reduce your taxable income by deducting:

- Pension contributions (8% of income)

- National Housing Fund (2.5% if applicable)

- Life insurance premiums (up to ₦100,000)

- Rent relief (20% of rent paid, capped at ₦500,000)

How You Can Stay Compliant

Step 1: Register for a TIN

Visit the FIRS website (https://www.nrs.gov.ng/) or your State Internal Revenue Service office. You'll need a valid ID, BVN, and proof of address. Registration is free.

Step 2: Track Your Income

Keep records of:

- Every payment (date, amount, currency, CBN rate on that date)

- Transaction history from platforms you use (Juicyway, Payoneer, Wise)

- Crypto trades (buy price, sell price, dates)

Why this matters: If you receive payments through fintech apps like Juicyway linked to your BVN, your transactions are visible to tax authorities through data-sharing agreements. This makes compliance easier because your records are already tracked.

Step 3: File Your Annual Return

- Visit TaxPro Max (FIRS e-filing portal) or your State IRS website

- Add up all income (convert foreign earnings to Naira using CBN rates)

- Subtract allowable deductions

- Apply progressive tax bands to calculate what you owe

- Submit by March 31st following the tax year (Income earned Jan-Dec 2026 → File by March 31, 2027)

If you earn below ₦800k, file a Nil Return but pay nothing.

Step 4: Pay Your Tax

After filing, FIRS will assess your return and issue a payment notice. Pay via bank transfer or approved government channels and keep your receipt.

Frequently Asked Questions

"What if I'm paid in crypto but don't convert immediately?"

You're taxed based on the value when you received the payment, not when you convert. If the value increases later, that increase is taxed separately when you sell.

"What if I earn below ₦800,000?"

You don't owe tax, but you may need to file a Nil Return. Check with FIRS to confirm your filing requirement.

Do I need to declare income received via a fintech app like Juicyway?

Yes. Payments received through fintech platforms are linked to your BVN or bank account and are visible to tax authorities. You must declare these amounts, using the CBN rate for conversion.

"What if I already paid tax abroad?"

If you paid tax on your foreign earnings in a country with which Nigeria has a **DTA(**Double Taxation Agreement), you can claim a credit against your Nigerian tax. Keep official documentation of the foreign tax paid. Nigeria has a DTA with 16 countries, including the UK, Canada, South Africa, and others.

"What if I don't comply?"

Penalties include ₦50k for late registration, ₦100k for late filing, plus monthly charges. FIRS is getting stricter with enforcement.

How Juicyway Can Help

Juicyway doesn't provide tax advice or file taxes for you. But here's what helps:

- Automated transaction history: The app logs every deposit, withdrawal, swap and transfer with dates and amounts, helping you maintain accurate records.

- Multi‑currency tracking: Transactions are recorded in both the original currency and Naira, making it easy to calculate taxable income and match with the CBN rate.

- Descriptive fields: Mandatory transaction descriptions allow you to state the purpose of each payment, useful for distinguishing income from gifts or reimbursements.

Use Juicyway’s export features to download your transaction history when preparing your tax return.

Final Thoughts

Nigeria's tax reform brings clarity to what was already supposed to be taxed. If you're earning foreign income, you've always been taxable under Nigerian law. What's new is the enforcement and structure.

Which is why we created this article to guide you.

So get compliant now. Register for your TIN. Track your income, and File on time.

You don't need to worry; you just need to be informed.

Need to track your foreign income accurately?

Juicyway’s multi‑currency transaction history can help you stay organised while you focus on your work.

Disclaimer: This article is for informational purposes only and does not constitute tax, legal, or financial advice. For specific guidance on your tax situation, consult a qualified tax professional or the Federal Inland Revenue Service (FIRS).