When it comes to making dollar transactions in Nigeria, you’re likely using a domiciliary account from your local bank. Despite being accessible, the processes surrounding it are burdensome—hunting scarce dollars, queueing at the bank for a withdrawal or a payout—and full of friction.

In this post, we break down what a domiciliary account is, why it’s not always ideal, and how Juicyway offers a faster, simpler alternative for managing USD and other currencies.

What is a Domiciliary Account?

A domiciliary (popularly called ‘dom’) account is a bank account that lets you receive and hold foreign currencies like USD, GBP, or EUR. It’s commonly used across Africa for cross-border payments especially in Nigeria, where many people rely on it for freelancing, business, or remittances.

But here’s the catch: Dom accounts can be slow, with avoidable limitations like limited dollar availability, bank delays, physical queues, endless paperwork, and high fees.

JuicyWay: The Smarter Digital Alternative

Imagine needing to make a quick dollar transaction—but all you have is your domiciliary account. You’re at home, maybe watching a movie or caught up in something important, when it hits you: go to the bank? Fill out forms? Not exactly what you feel like dealing with.

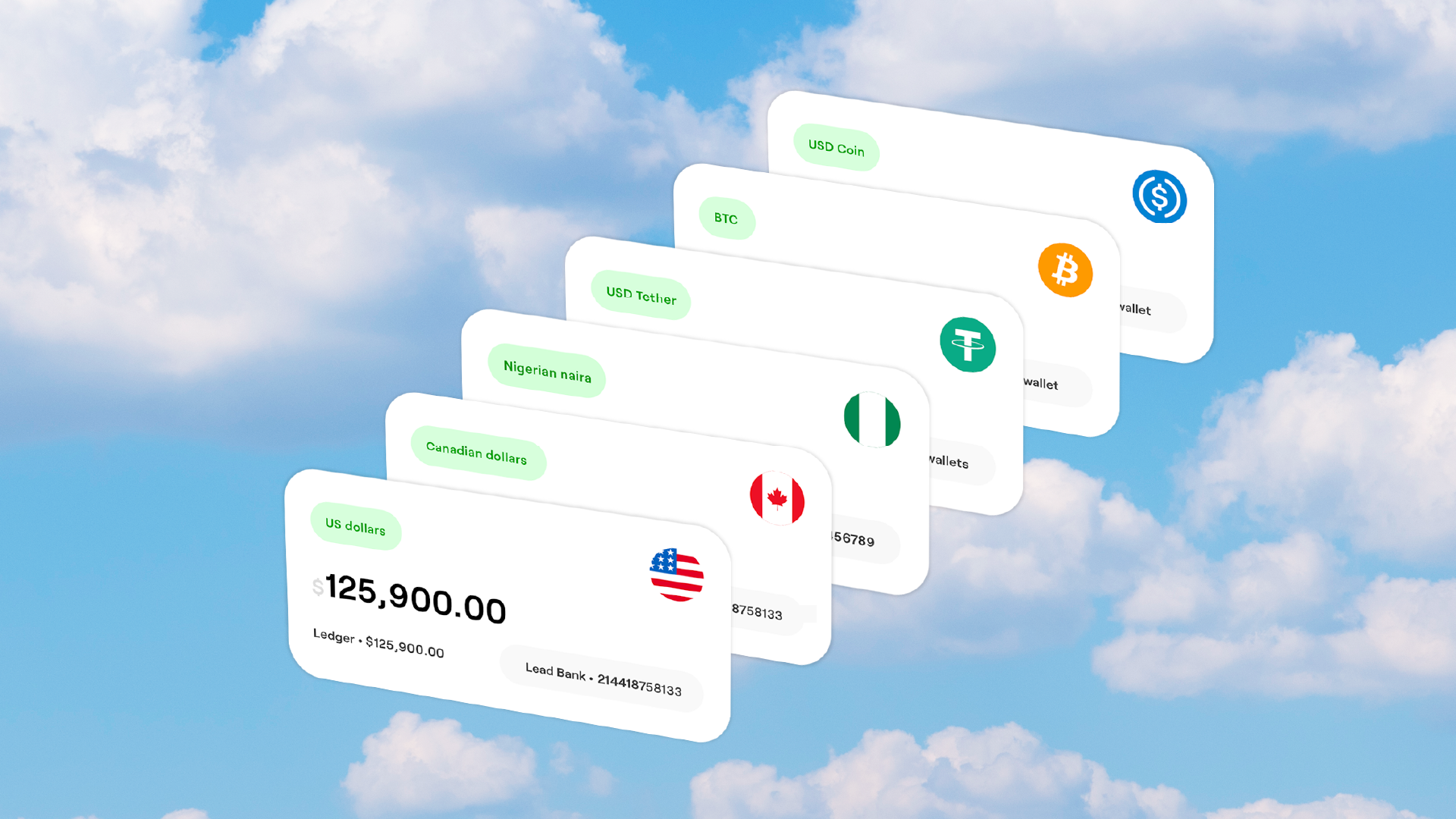

Juicyway keeps things simple. With our app, you can send, receive, and manage multiple currencies—NGN, USD, CAD, GBP, Euro, and even stablecoins like USDT—all in one place.

We support every last-minute transaction, emergencies, or just everyday international payment. Juicyway isn’t just an alternative to your DOM account. We’re a full upgrade!

How to Transfer from Your Domiciliary Account to Your Juicyway USD Wallet

The answer to the big question “How do I do it?”, first, you will need a Juicyway account. But if you already have one, then you’ll want to get a USD account so you can move funds from your domiciliary account into your USD wallet.

Here’s how to go about it. If you’re new to Juicyway, we’ve also got you covered with the steps to get started.

Step 1: Download and Sign Up

If you don’t already have the app:

- Head to your iOS App Store or Google Play Store.

- Search for Juicyway – Swap & Send Money and download it.

- Open the app, sign up, and complete a quick verification process.

Once signed in, your Naira wallet will be automatically created. To access other currencies wallets (like USD), you’ll need to set them up.

Step 2: Create Your USD Wallet

To create your USD wallet:

- In your app page, right under the NGN dashboard

- Select “Request USD account”

- Follow the steps to submit your basic details like BVN, upload a valid ID (National ID or Driver’s License) and a document that confirms your address, after which you will undergo a quick review process.

- Once verified, you’ll be assigned a unique USD account number and bank details.

Step 3: Fund Your Juicyway USD Wallet from Your Domiciliary Account

Welcome to the juicy part, your USD wallet is active and here’s how to move funds from your domiciliary account into it:

First you can either use your banking app or visit your bank physically — whichever works for you.

- Log into your app.

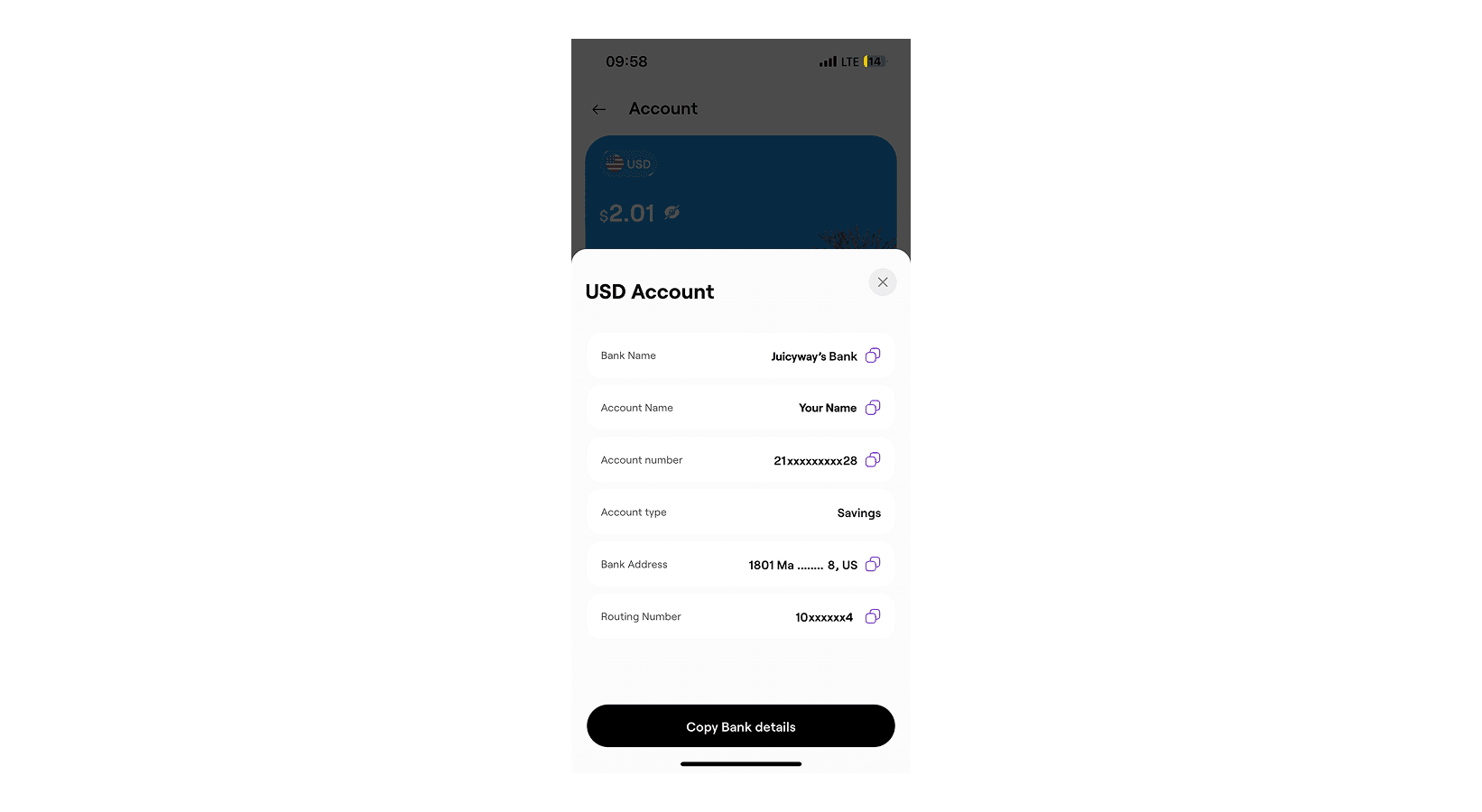

- Go to your USD wallet, and click on “Bank Details.”

- Here you’ll find key information you’ll need for the transfer:

- Bank Name

- Account Name

- Account Number

- Bank Address

- Routing Number / SWIFT Code

When making the transfer:

- Copy and input the exact account number, routing/SWIFT code, and bank name into your bank's platform/form.

- Double-check that all details are correct before confirming.

Your transaction details should look like this:

Wait—routing number or SWIFT code? Here’s the simple breakdown: If you're transferring from your domiciliary account, you’ll need a SWIFT code to complete the transaction. But Juicyway’s USD account runs through a U.S.-based banking partner, so use the routing number provided in your Juicyway USD account details—that’s what actually gets your money to the right place.

For First-Time Transfers

On your first deposit into JuicyWay, a quick compliance check will be run to verify the source of funds. This process usually takes 1–2 business days, after which your wallet will be funded, and you’ll be notified. After this, future transfers become smooooth.

Once you have gone through all processes, you have successful saved yourself a truckload of stress visiting the bank.

Domiciliary (or Dom) accounts aren’t bad—but if you’re looking for something faster, less stressful, and more in your control, Juicyway gives you exactly that: the freedom to manage and move money in multiple currencies with just a few taps.

Ready to join the Juicyway family? Sign up today.

DISCLAIMER

This publication is for informational purposes only and should not be considered legal, tax, or professional advice. Please consult a licensed financial advisor for personalized guidance.