Introduction

The U.S. Dollar (USD) which has long been regarded as the world's dominant reserve currency and ultimate safe-haven asset, has taken an unexpected turn in 2025. While geopolitical tension and inflation remain on the global radar, the USD has quietly become the worst-performing major currency so far this year. The implications of this decline ripple across fiat markets, emerging economies, and the growing domain of cryptocurrencies.

The U.S. Treasury has publicly denied using the dollar as a tool in trade negotiations. However, the currency has already declined by 8% since the current administration took office. This discrepancy between market movement and official rhetoric has left investors skeptical — reading between the lines for any signal that a weaker dollar may be quietly tolerated, even if not formally pursued.

This in-depth analysis unpacks:

- Why the dollar is falling

- Which currencies are gaining ground

- How this trend affects crypto and stablecoins

- What it means for cross-border businesses and platforms like Juicyway

What's driving the Dollar's weakness in 2025?

A key driver behind the dollar's weakening is the Federal Reserve’s unexpected pivot toward monetary easing. With inflation slowing and political pressure mounting, the Fed began cutting interest rates earlier than anticipated. This reduced the appeal of dollar-denominated assets, triggering a pullback from global investors. At the same time, the U.S. government's ongoing fiscal expansion, marked by large infrastructure and defense packages, has reignited long-standing concerns over the sustainability of American debt. Credit rating agencies have responded with caution, hinting at possible downgrades that could further shake investor confidence.

Beyond America’s borders, a global movement toward de-dollarization continues to gain steam. Countries like China and Russia, along with BRICS members, are accelerating efforts to settle trade in local currencies or gold-backed instruments. Central banks are also gradually rebalancing their reserves, shifting away from the dollar in favor of more diversified holdings.

In parallel, there’s growing market chatter around what some analysts call “policy coordination whispers”, which are subtle signs that global central banks may be aligning strategies to navigate shared challenges around inflation, growth, and currency stability. These developments have benefited currencies like the euro, Chinese yuan, and Swiss franc, each of which has appreciated as confidence in the dollar wavers.

Implications for cryptocurrency and stablecoins

These currency shifts are also influencing how investors view crypto assets.

- Bitcoin and Ethereum

With dollar confidence eroding, more institutional investors are rebalancing portfolios with crypto, not as a hedge against inflation per se, but as a diversification away from fiat concentration.

- USDT and USDC

Ironically, while pegged to the USD, these stablecoins face pressure due to questions around dollar reserves and potential off-peg risk in moments of macro volatility.

Alternative stablecoins like EURC (Euro-pegged) or even Gold-backed tokens are gaining traction.

What It Means for Juicyway Users

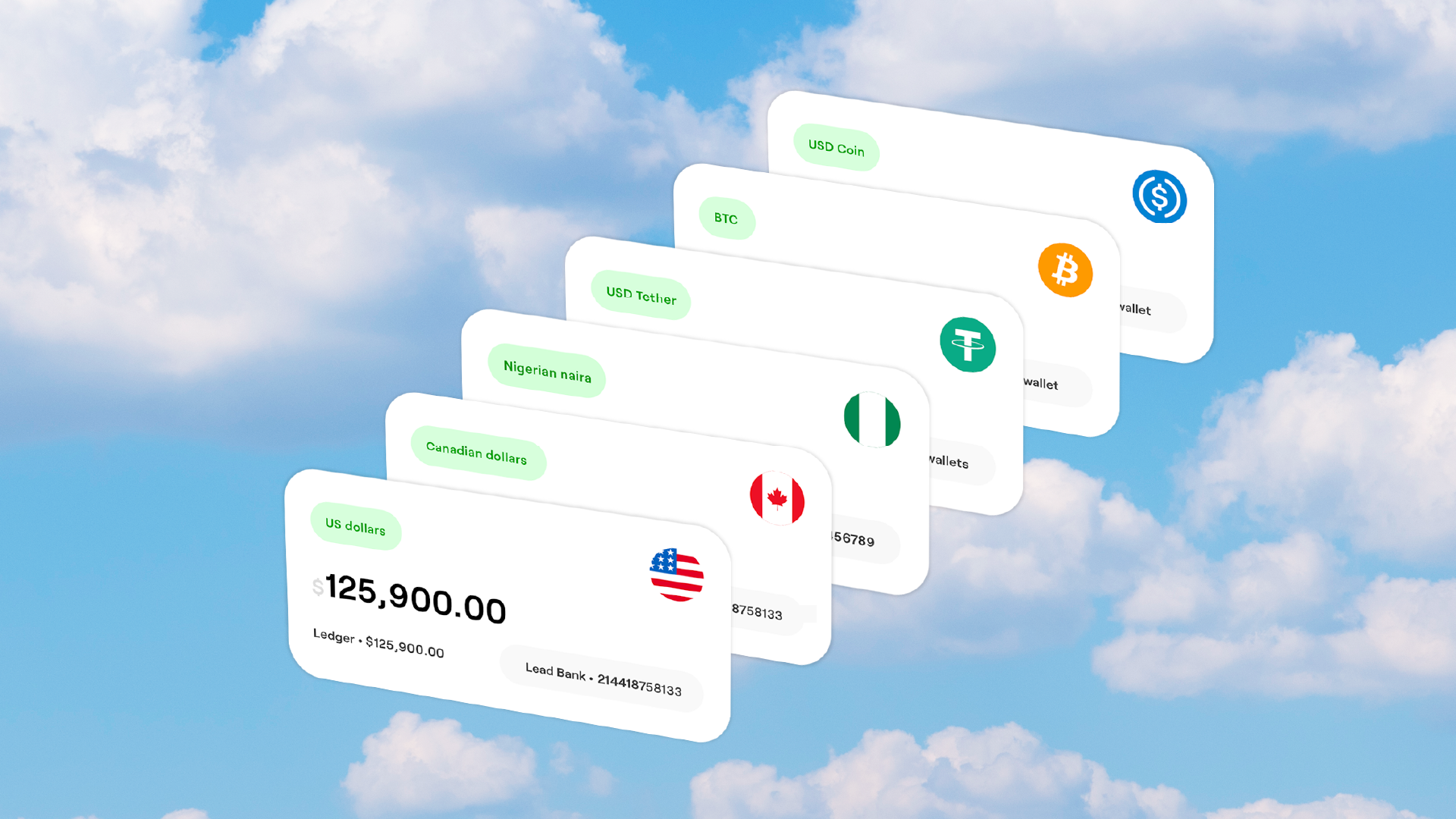

As a platform facilitating multi-currency payments, Juicyway stands at the center of this transition. Here’s how the dollar’s decline affects activity:

1. More Competitive FX Rates into NGN

With a weaker dollar, converting USD to NGN becomes more favorable. For Juicyway users, this means better exchange rates on USD→NGN transfers — potentially boosting remittance volume from the U.S. corridor.

2. Shifting Preferences to CAD, GBP, and Crypto

Users in Canada and the UK are already turning to their local currencies or crypto due to more stable rate expectations. Juicyway’s CAD→NGN and GBP→NGN routes have seen rising activity.

3. Increased Use of Crypto On-Ramps

Users are leveraging USDT and USDC deposits but increasingly converting into NGN or stable alternatives faster, due to concerns about USD volatility.

4. Opportunity for FX-Conscious Businesses

Businesses using Juicyway to manage treasury across USD, NGN, GBP, and crypto can strategically time conversions or use hedging tools as volatility rises.

Conclusion: A Turning Point?

2025 may be remembered as the year USD exceptionalism was truly tested. While no currency dethrones the dollar overnight, investor behavior, institutional flows, and technological enablers like crypto and platforms like Juicyway may be subtly reshaping the global currency order. Be flexible and monitor FX trends with Juicyway.